What is an Assessment Notice?

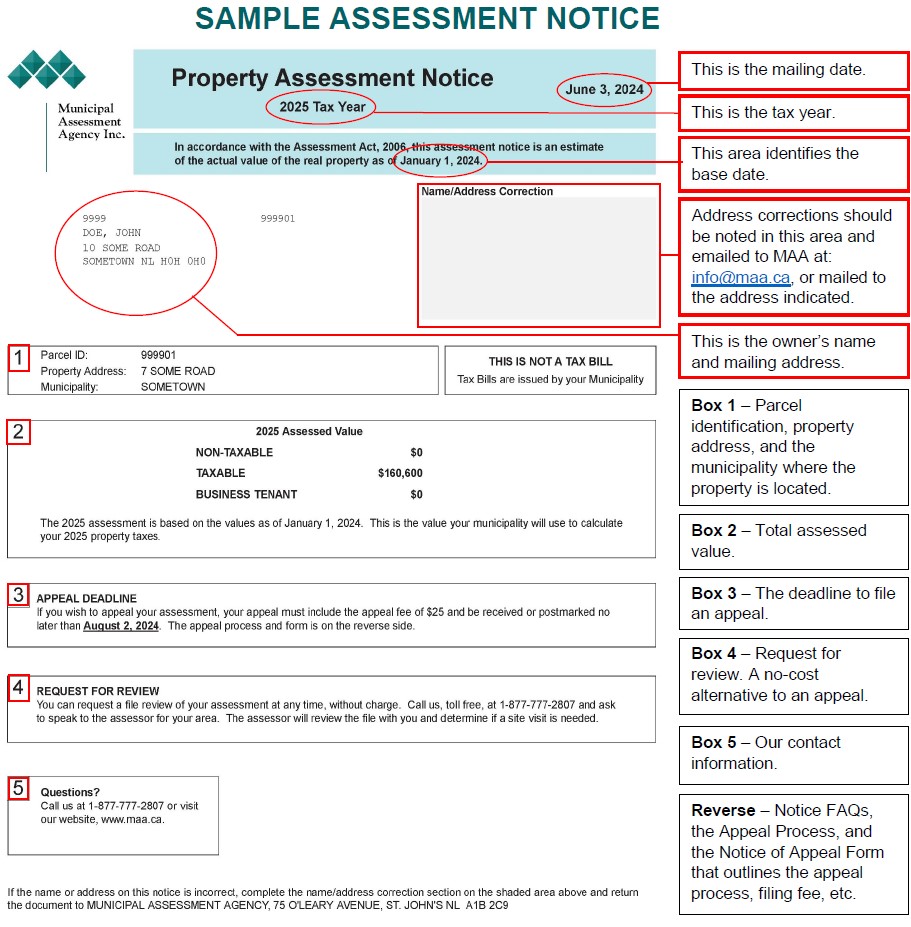

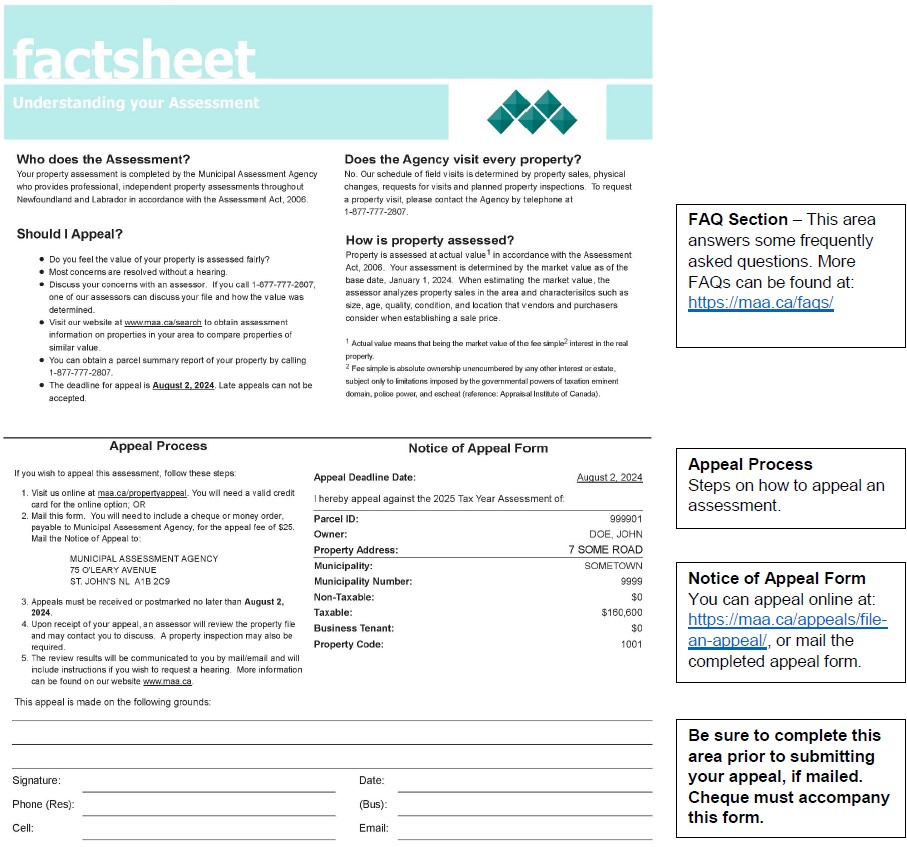

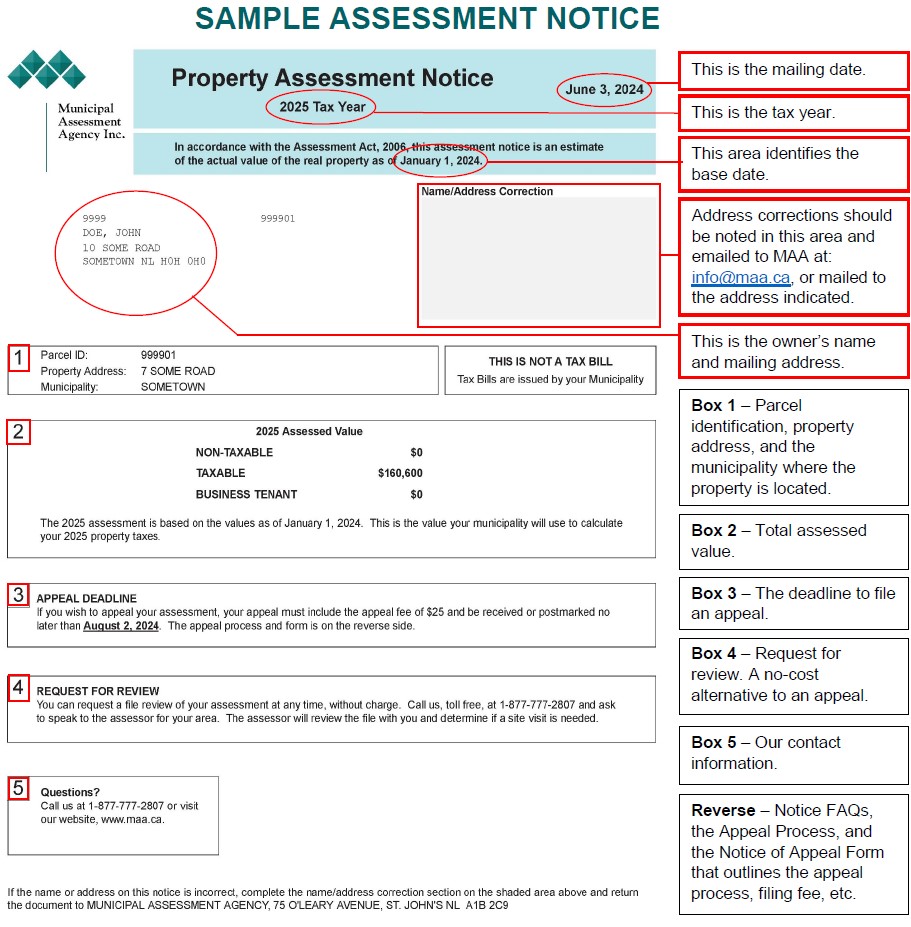

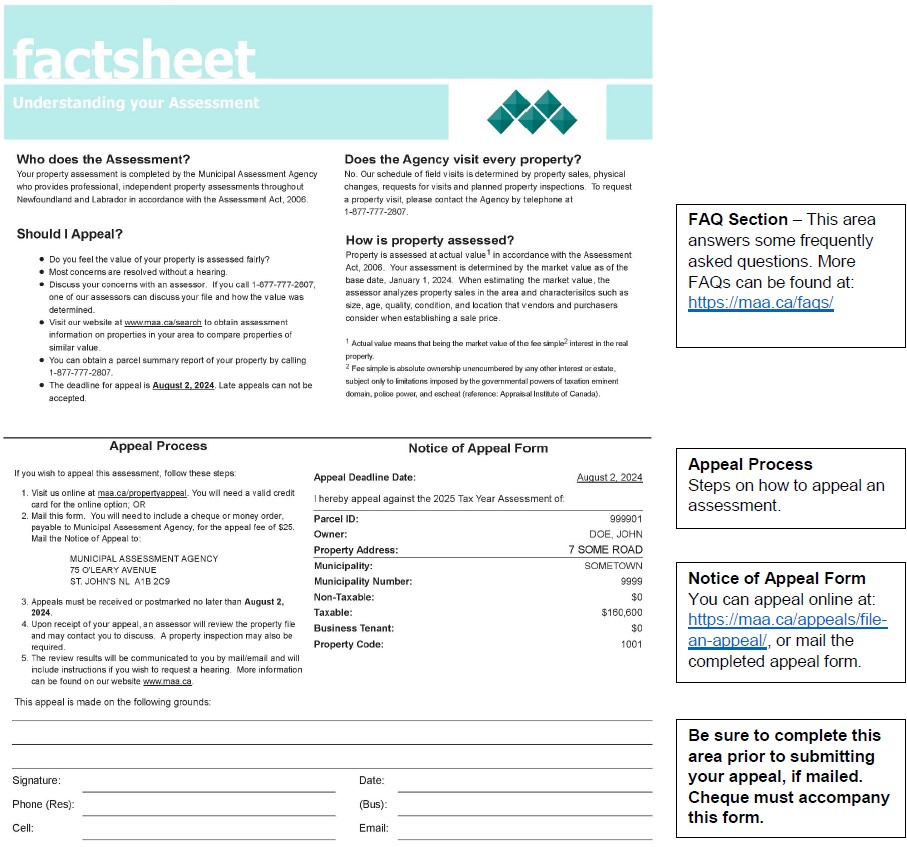

When all the assessments for a municipality have been completed, each property owner receives an assessment notice by mail. Download a sample assessment notice here.

When all the assessments for a municipality have been completed, each property owner receives an assessment notice by mail. Download a sample assessment notice here.